How Inflation Quietly Erodes Your Retirement Income

Inflation: The Silent Threat to Retirement Security

Most retirees think about market risk, healthcare costs, and outliving their savings. But there’s one danger that quietly chips away at your financial confidence—inflation.

Unlike a market crash, inflation doesn’t make headlines every day. It slowly erodes your purchasing power year after year. And by the time you feel its full impact, it’s often too late to adjust.

If you’re planning for retirement—or already in it—understanding how inflation affects your income is critical to keeping your lifestyle and peace of mind intact.

How Inflation Impacts Retirees

Inflation means that the same dollar buys less over time. That $100 you spent on groceries ten years ago? It might cost $130 or more today.

While inflation affects everyone, retirees are especially vulnerable because:

- They rely heavily on fixed income sources like pensions or annuities

- They often have fewer opportunities to increase their income

- Healthcare costs—already rising faster than inflation—are a growing expense

Even “moderate” inflation of 3% annually cuts your purchasing power in half in just 24 years.

Real vs. Nominal Income: Why It Matters

Let’s say your retirement income is $4,000 a month. On paper, that number may not change—but the value behind it does.

| Year | Nominal Income | 3% Annual Inflation | Real Purchasing Power |

|---|---|---|---|

| 0 | $4,000 | 0% | $4,000 |

| 10 | $4,000 | ~30% cumulative | ~$3,000 |

| 20 | $4,000 | ~80% cumulative | ~$2,200 |

Result? You’re earning the same amount—but living on far less.

Which Retirement Income Sources Adjust for Inflation?

Which Retirement Income Sources Adjust for Inflation?

| Income Source | Inflation Protection |

|---|---|

| Social Security |

Annual Cost-of-Living Adjustment (COLA) Annual Cost-of-Living Adjustment (COLA) |

| Pensions |

Some offer COLAs, most do not Some offer COLAs, most do not |

| Fixed Annuities |

Fixed payment unless rider added Fixed payment unless rider added

|

| Fixed Indexed Annuities (FIAs) |

Potential for market-linked growth without loss Potential for market-linked growth without loss |

| Investment Portfolio Withdrawals |

Can outpace inflation—but comes with market risk Can outpace inflation—but comes with market risk |

Relying too much on fixed payments can leave you falling behind in later years. A balanced strategy is essential.

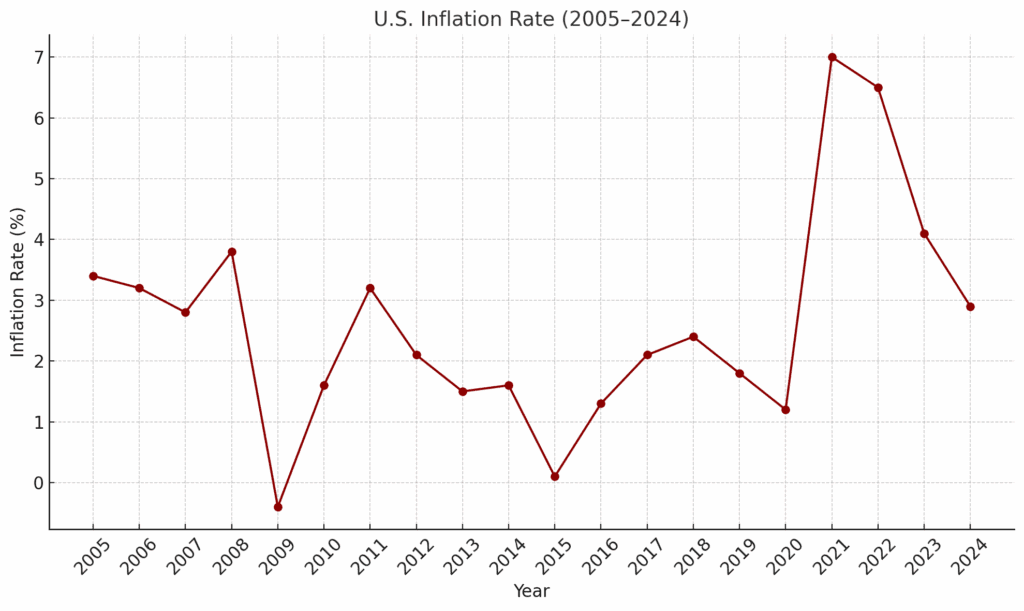

U.S. Inflation (2005–2024)

Source: U.S. Bureau of Labor Statistics CPI‑U data, via Investopedia and Macrotrends.

Strategies to Protect Retirement Income from Inflation

1. Maximize Social Security

Waiting until age 70 to claim can increase your benefit by up to 8% annually. And since benefits come with COLAs, this higher base grows even more over time.

2. Use FIAs for Flexible Growth

Fixed Indexed Annuities provide principal protection, with the opportunity to earn market-linked gains—without the downside of market losses.

This blend of growth and safety makes them a valuable tool to help keep pace with inflation.

3. Diversify Your Income Streams

Don’t rely on a single source of income. Mix guaranteed options like annuities with growth-oriented assets like Roth IRAs or dividend-producing investments.

4. Budget with Future Prices in Mind

Build future costs into your retirement projections. Assume healthcare will rise faster than inflation—and make sure your income plan adjusts accordingly.

An Example of Inflation in Action

Imagine two retirees, Jim and Susan. They both retire at age 65 with $4,000 per month in retirement income.

- Jim relies on a fixed pension and withdrawals from a CD ladder.

- Susan uses Social Security, a FIA with growth potential, and a Roth IRA.

At age 75, inflation has pushed prices up 30%—but Jim’s income hasn’t changed. Susan, however, has seen her Social Security increase annually, and her annuity gained modest market-linked growth.

Result? Jim is forced to cut spending. Susan maintains her lifestyle.

Peace of Mind Starts With a Future-Focused Plan

You can’t control inflation—but you can prepare for it. Here’s how:

- Build income that grows (or can grow) over time

- Use protected strategies like FIAs or delayed Social Security

- Review your plan regularly and adjust for rising costs

- Work with a professional who understands inflation risk

Inflation isn’t a headline. It’s a reality—and a smart retirement plan keeps it from becoming a crisis.

Want to Know If Your Income Can Handle Inflation?

Visit SafeMoney.com to get expert retirement guidance and explore solutions designed to preserve your income—and your peace of mind—for decades to come.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

The post How Inflation Quietly Erodes Your Retirement Income first appeared on SafeMoney.com.

Featured Blogs

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?

- Why You Still Need a Will—Even If You’re Retired

- Quarles and Herring of Financial Longevity Advisory

- From Retirement Ready to Legacy Ready: What Comes Next?

- What’s Your Retirement Goal—and Are You on Track?

- How Inflation Quietly Erodes Your Retirement Income

- Peace of Mind in Retirement Starts With a Plan

- Avoiding Retirement Surprises Most People Miss

- How Social Security Timing Impacts Retirement Income

- Smart Tax Moves That Boost Retirement Income Longevity

- Spotlight Series Interview with Paul R. Lowe

- Avoiding Market Risks in Retirement: Why It Matters

- How to Create a Retirement Paycheck That Lasts

- How to Fill the Gaps in Your Retirement Income Plan

- Guardian Investment Advisors: Plan with Purpose

- Is Your Retirement Plan Ready for the Real World?

- A Holistic Retirement Strategy with Marlene Woodyard

- 3 Retirement Mistakes That Can Still Be Fixed in 2025

- The Power of Zero: Protecting Retirement from Losses

- What Happens If You Outlive Your Retirement Savings?